Bonus Depreciation 2024 Percentage Increase

The full house passed late wednesday by a 357 to 70 vote h.r. 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research.

How is bonus depreciation set to change in 2024? 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research.

The Bonus Depreciation Bill, Recently Passed By The U.s.

Bonus depreciation deduction for 2023 and 2024.

How Is Bonus Depreciation Set To Change In 2024?

179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum.

Images References :

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum. 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in. Retroactively restores the ability to deduct research and.

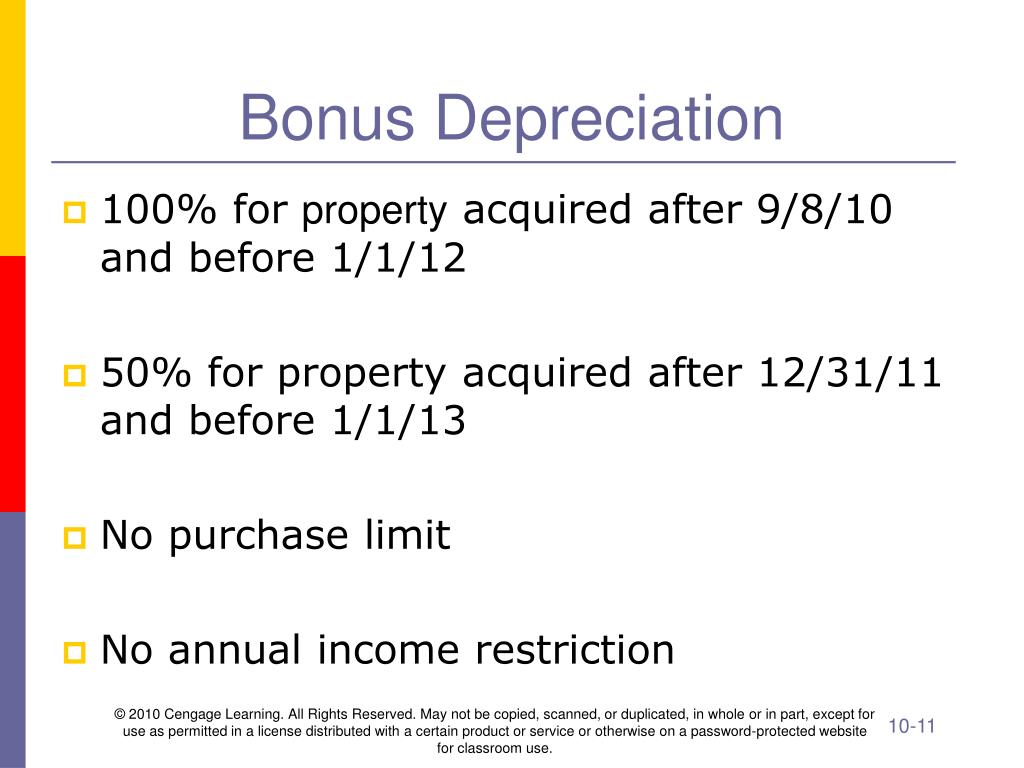

Source: www.slideserve.com

Source: www.slideserve.com

PPT Chapter 10 PowerPoint Presentation, free download ID513324, 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum. The bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026.

Source: ademolajardin.blogspot.com

Source: ademolajardin.blogspot.com

Bonus depreciation calculation example AdemolaJardin, 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research. In 2024, the bonus depreciation rate is set to reduce from 80% to 60%.

Source: www.matthews.com

Source: www.matthews.com

Bonus Depreciation Expiration, The $2,000 value of the. The bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026.

Source: investguiding.com

Source: investguiding.com

Rental Property Depreciation How It Works, How to Calculate & More (2024), In 2024, the bonus depreciation rate is set to reduce from 80% to 60%. For 2023, businesses can take advantage of 80% bonus depreciation.

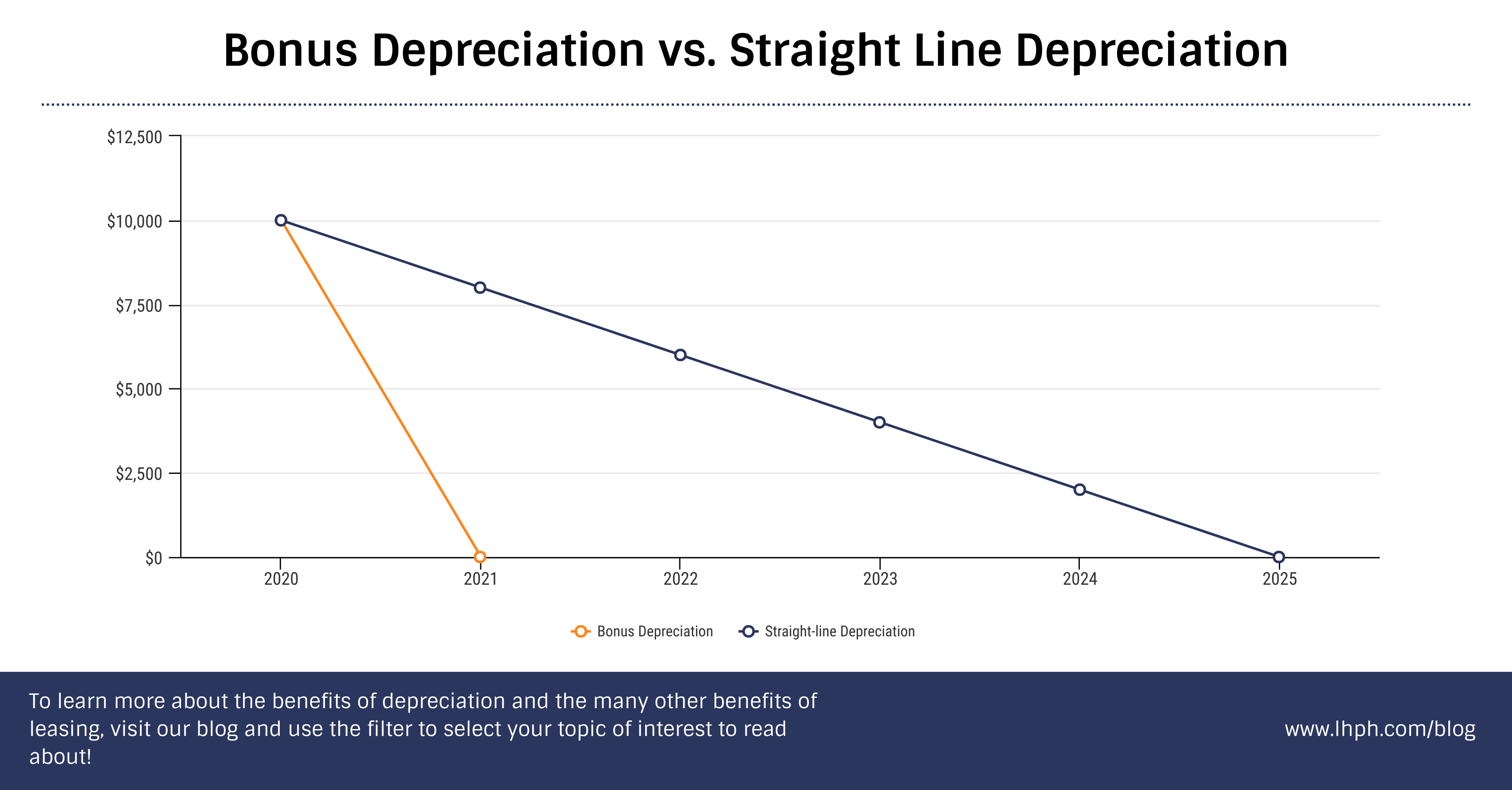

Source: www.lhph.com

Source: www.lhph.com

Bonus Depreciation vs. StraightLine Depreciation LHPH Capital, The bill increases the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024 and $2,000 in tax year 2025. The tax bill would increase the expense amount up to $1.29 million and raise the cap for qualifying property up to $3.22 million.

Source: taxfoundation.org

Source: taxfoundation.org

100 Bonus Depreciation Permanence Offers More Bang for the Buck, The tax relief for american families and workers act of 2024, h.r. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first.

Source: www.energy.gov

Source: www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy, 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum. The full house passed late wednesday by a 357 to 70 vote h.r.

Source: globalfinishing.com

Source: globalfinishing.com

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, For 2023, businesses can take advantage of 80% bonus depreciation. Both amounts would increase based.

For 2023, Businesses Can Take Advantage Of 80% Bonus Depreciation.

Most significantly, the cost of bonus depreciation more than doubled from $25 to $54 billion (0.08 to 0.16.

This Means Businesses Will Be Able To Write Off 60% Of.

The bonus depreciation bill, recently passed by the u.s.

Posted in 2024